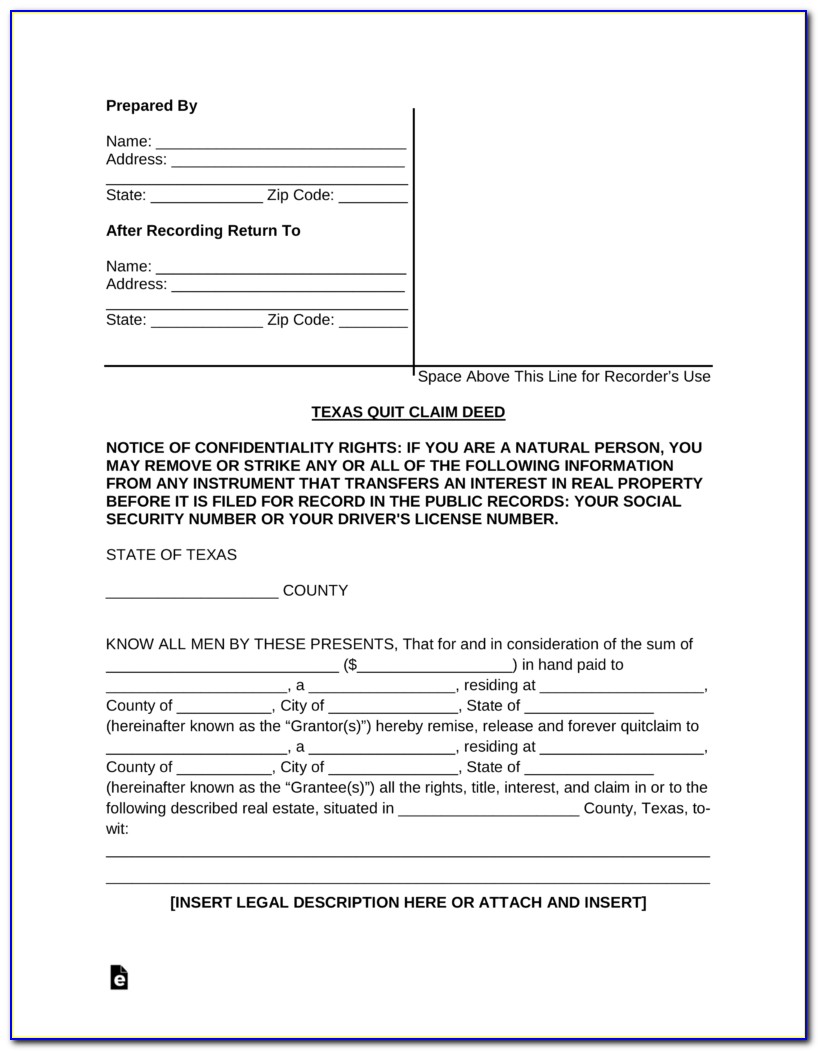

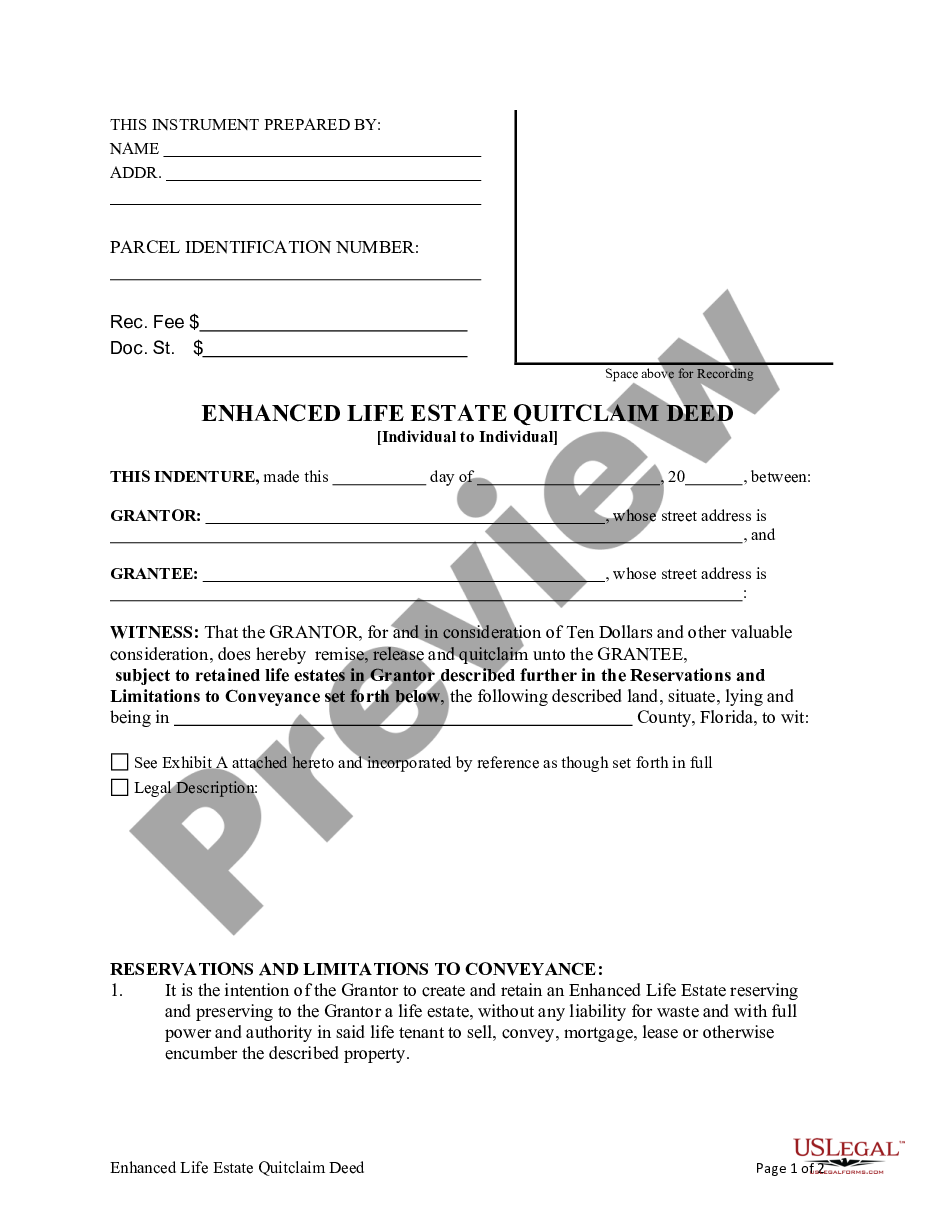

It describes the property’s features, specifications, location, registration, and other pertinent issues. This legal description states that the property in finer details. The consideration is what that to take over the ownership of the property the grantee provides to the grantor in exchange for the right. It is the core of the deed that actually does the transfer of the property to a new party.

This another party is known as grantee that may be a natural person, an LLC, a partnership, a corporation, trust or trustee.Ī person who receives the ownership rights of the property that is being transferred is known as grantee. The title clearly spells out ‘quitclaim deed form’ in this kind of a document.Įxecuted day is the date when the legal document was signed, executed, and completed by the parties involved.Ī grantor is an individual who surrenders his rights to the piece of property to another party. Contents of a Quitclaim deed form:Ī quitclaim deed form includes the following components Likewise the corporation or limited liability company, it is also used to facilitate the transfers to a trust. If the hold property is in the custody or protection of a limited liability company or corporation, then this form is used to transfer the ownership to and from the concerned parties. Transferring the legal ownership to a corporation or LLC To make the form up to date and relevant, you have to reflect the new name on it. The form yet again comes in handy in the course of such changes. Time to time, property owners change their names. This situation may occur due to divorce or when entering a marriage. You will rely extensively on this form if you have to add or eliminate a souse from a title. Including or eliminating spouses from a tile These members could be parents and children, two siblings, and other closely-related family members. Here are some situations where you can use a quitclaim deed form Transferring property among family membersĪ quitclaim deed form is used while transferring property among two members of the same family. Transferring the legal ownership to a corporation or LLC.

0 kommentar(er)

0 kommentar(er)